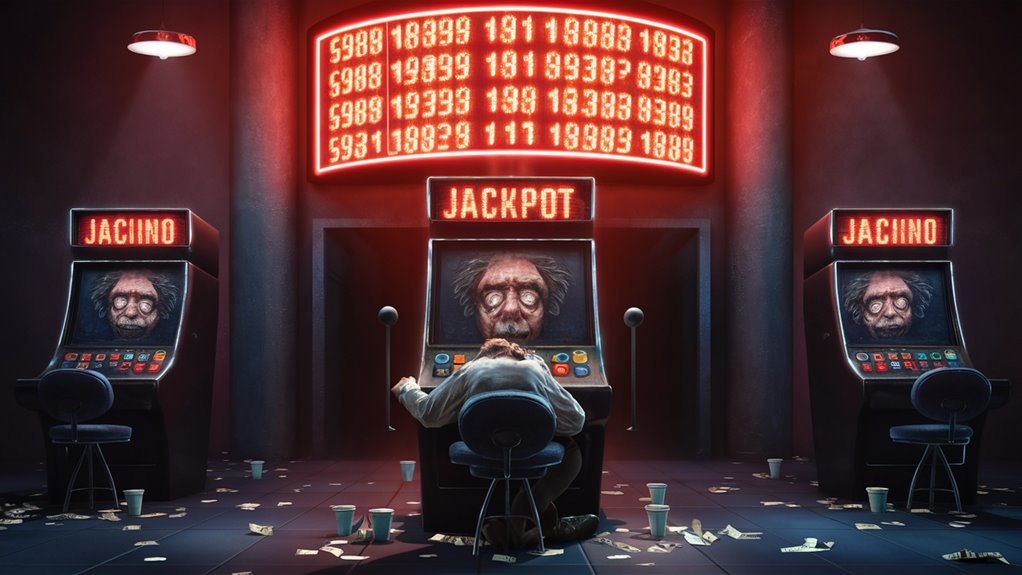

Ever notice how lottery fever spreads when jackpots hit those mind-boggling numbers? It’s no accident. The whole setup is like a perfectly crafted recipe that knows exactly how to tap into our deepest dreams and desires. Think about it – those giant prize displays, endless news coverage, and the buzz on social media all work together to create an irresistible pull.

While most folks can buy a ticket or two and go about their day, it’s a different story for people who struggle with gambling risks. You know that feeling when you’re watching your favorite sports team, and they’re just one point away from a huge win? That’s nothing compared to the rush some people get when they imagine holding that winning ticket.

Your brain actually plays a fascinating trick here. Even when you know the odds are astronomically low (like, seriously – you’re more likely to become a saint or get struck by lightning), something clicks in your head that says “but what if?” The possibility of instant wealth becomes so powerful that logic takes a backseat. It’s like your common sense is whispering “careful now,” but the jackpot numbers are shouting through a megaphone.

The really tricky part is how these mega-jackpots can turn casual players into risk-takers. One minute you’re buying a single ticket for fun, and before you know it, you’re checking the numbers obsessively and planning how you’ll spend millions. It’s pretty wild how our brains can convince us that impossible odds don’t matter when there’s life-changing money on the line.

The Psychology Behind Mega Jackpots

Let’s talk about what really happens in our brains when we see those jaw-dropping mega jackpots. You know those moments when you’re staring at the lottery numbers, thinking about what you’d do with millions? Well, there’s actually some fascinating psychology behind it.

Think of your brain like a chemical factory that goes into overdrive when you spot a massive jackpot. It starts pumping out dopamine, that feel-good substance that makes you all tingly with excitement.

It’s kind of like being a kid on Christmas morning, except instead of presents under the tree, you’re dreaming about life-changing money.

The really interesting part is how these huge prizes mess with our common sense. We start daydreaming about quitting our jobs, buying dream homes, and helping out everyone we know.

Before you know it, rational thinking goes right out the window, and we’re calculating how many tickets to buy instead of considering the actual odds.

Have you ever come super close to winning and felt your heart skip a beat? That’s what experts call a “near miss,” and it’s pretty sneaky how it works.

Your brain actually treats these almost-wins like mini victories, which keeps you coming back for more. When there’s a massive jackpot on the line, these near misses feel even more significant.

And then there’s the power of success stories. Every time we see news about some lucky winner from a small town who hit it big, we think, “Hey, why not me?”

It’s like our brain conveniently forgets that the odds are astronomical, because someone has to win, right?

The whole thing is a bit like being caught up in a really compelling movie. You know it’s not real, but you can’t help getting swept along in the excitement and possibility of it all.

Problem Gambling Warning Signs

Let’s talk about gambling for a minute. While dreaming about hitting that big jackpot can be harmless fun for most people, things can sometimes take an unexpected turn.

You know how it goes – what starts as casual entertainment might slowly drift into risky territory if we’re not careful.

So how can you tell if things are getting out of hand? Well, start by taking an honest look at your habits. Are you spending more time and money at the casino or on betting apps than you planned?

Maybe you’ve found yourself borrowing cash just to stay in the game, or you’re keeping your gambling activities under wraps from friends and family.

Here’s something to think about: that urge to chase losses is a classic red flag. You might catch yourself thinking, “Just one more bet and I’ll win it all back.”

And when you can’t gamble? That restless, irritable feeling isn’t just coincidence.

The warning signs can really add up. Perhaps you’re calling in sick to work so you can gamble, or missing important family events.

Using gambling as an escape from life’s problems? That’s another signal worth paying attention to.

And let’s be real, if you’re hiding bank statements or selling your stuff to fund your bets, it’s time to pause and reflect.

Your body might be sending signals too. Feeling anxious? Having trouble sleeping?

These physical symptoms often go hand in hand with problem gambling. Look, there’s no shame in admitting things have gotten tough.

If any of this sounds familiar, reaching out to a professional counselor could be the best bet you’ll ever make.

Media Coverage and Gambling Behavior

Let’s talk about how media coverage shapes our thoughts about gambling. You know how it goes – you’re scrolling through your news feed, and suddenly there’s another story about someone hitting the jackpot. Pretty tempting, right?

The way news outlets cover gambling can really get inside our heads. They love splashing those big lottery numbers across headlines, especially when they hit record-breaking amounts.

And let’s be honest, it’s hard not to get caught up in the excitement when you see those life-changing figures.

Think about it – when was the last time you saw a headline about someone losing their savings at a casino? Probably never.

Instead, we’re flooded with stories about regular folks becoming millionaires overnight. This creates what experts call “jackpot fever,” where we start believing we could be next, despite the odds being incredibly slim.

Social media makes this even trickier to navigate. Your friend posts about winning $50 on a scratch card, another shares their “almost won big” story, and suddenly gambling seems like a pretty good idea.

What you don’t see are all the losses that never make it to anyone’s timeline.

To keep things in perspective, remember that media coverage is a bit like a highlight reel – you’re only seeing the best moments.

Just like how no one posts their bad hair days on Instagram, most people don’t share their gambling losses either. The real story includes countless people who’ve lost money chasing those headline-worthy wins.

Financial Impact on Risk-Prone Players

Let’s talk about the hidden side of those exciting jackpot stories that grab headlines. While they might sound amazing, there’s a tougher reality for folks who struggle with gambling. You know how it goes – when you’re already drawn to taking risks, those big prize announcements can really get under your skin and trigger some intense emotions.

The thing about gambling is, it can sneak up on you financially. Maybe you start small, just betting what you can afford to lose. But then something shifts.

Before you know it, you’re dipping into your savings account, maxing out credit cards, or worse, taking out loans to chase that next win. It’s like quicksand – the harder you try to get out, the deeper you sink.

Here’s a sobering fact: research shows that people who are prone to gambling risks typically spend nearly half more money during jackpot periods compared to regular gaming times. Pretty scary, right?

You might catch yourself thinking, “Just one more bet and I’ll win it all back,” but that’s exactly how the trouble starts. Soon enough, you’re juggling bills, dodging calls from collectors, and watching your credit score take a nosedive.

The ripple effect touches everything – your job performance might slip, family relationships get strained, and retirement planning? That goes right out the window.

And let’s be honest, when financial stress piles up, it rarely comes alone. It usually brings along unwanted guests like relationship problems and mental health challenges. It’s a tough cycle that starts with chasing wins but often ends up causing way more losses than just money.

Breaking the Big Prize Spell

Let’s talk about breaking free from that tempting jackpot fever. You know how it goes – those massive prizes have a way of getting into your head, making you dream about instant riches and a life of luxury.

But here’s the thing: we need to get real about these fantasies.

First up, take a minute to really look at those winning odds. Compare them to things you can actually wrap your head around, like getting hit by lightning or finding your car keys when you’re already running late. Pretty eye-opening, right?

When you feel that familiar itch to chase a big prize, give yourself a timeout. Make it a rule to wait at least 24 hours before making any betting moves.

During this cooling-off period, focus on what’s actually in your financial game plan. Remember those times when gambling didn’t quite work out? Yeah, keep those memories handy.

Want some practical steps? Set up strict spending limits with your bank. Better yet, grab some blocking software that keeps you away from those tempting gambling sites when you’re feeling vulnerable. You’ll thank yourself later.

If you’re finding it tough to resist those mega jackpots on your own, there’s no shame in reaching out for help. Support groups and professional guidance can make a world of difference.

Try channeling that excitement into something else that gets your heart racing without risking your wallet – maybe rock climbing or competitive sports?

Just remember, those big prizes? They’re designed to push your buttons. The house knows exactly what they’re doing with those flashy numbers.

But you can outsmart them by staying grounded in reality and keeping your financial boundaries rock solid.

Common Questions

Do Lottery Winners Statistically Tend to Lose Friends and Family Relationships?

You know how they say money changes everything? Well, when it comes to winning the lottery, your relationships might take an unexpected turn. Research has shown that many lottery winners face some pretty challenging times with their friends and family. It’s not just about the money itself – it’s the whole dynamic that shifts. Think about it: suddenly your old college buddy is asking for a loan, or your cousin has this amazing business idea they want you to invest in. Pretty awkward, right?

The thing is, jealousy tends to creep in, even with people you’ve known forever. One day you’re grabbing coffee with friends like usual, and the next they’re treating you differently because they know about your windfall. Trust becomes a bit shaky too – you might start wondering if people are being genuine or if they’re just interested in your newfound wealth.

Many lottery winners have actually reported losing longtime friendships and even seeing family relationships crumble. It’s kind of like getting a promotion at work, but multiply that tension by about a thousand. Some people might feel entitled to your money, while others might pull away because they feel uncomfortable with the new financial gap between you.

What Percentage of Jackpot Winners Choose Lump Sum Versus Annual Payments?

You know what’s fascinating about lottery winners? When it comes to choosing between a lump sum or annual payments, an overwhelming majority, around 80-90% of winners, go straight for the big one-time payout. It’s pretty understandable – who wouldn’t want all that money right away? But here’s the interesting part: most financial experts actually suggest taking the steady annual payments instead.

Think about it like this: imagine you’re at an ice cream shop, and you can either get one massive sundae right now or enjoy a smaller, delicious scoop every month for years. While that giant sundae looks tempting, spreading out those treats might help you savor them longer and avoid a stomach ache!

The psychology behind this choice is pretty simple. Most winners can’t resist the allure of instant wealth, even though getting those yearly checks could potentially mean more money in the long run and better protection from overspending. And let’s be honest – we’ve all heard those cautionary tales about lottery winners burning through their fortunes faster than you can say “jackpot.”

But really, can we blame people for wanting their money right away? Between inflation concerns, investment opportunities, and just plain old excitement, that lump sum option can be mighty tempting. Still, those rare 10-20% who choose the annual payments might be onto something when it comes to smart money management.

How Many Winners Have Successfully Maintained Complete Anonymity After Claiming Prizes?

Let’s talk about lottery winners and their quest for privacy. You might be surprised to learn that keeping your identity under wraps after hitting the jackpot isn’t as simple as you’d think. The reality is, only a handful of lucky winners manage to stay completely anonymous, mainly because just 11 states in the U.S. allow winners to keep their identity secret.

Most state lottery commissions actually require winners to go public, which can be pretty nerve-wracking if you’ve just won millions. But some clever winners have found ways around this. They’ve used legal tools like trusts or limited liability companies (LLCs) to shield their identity from the public eye.

Think about it like this: imagine winning millions but having to tell everyone in your neighborhood about it. That’s the situation most lottery winners face. While some states are starting to recognize privacy concerns and consider changing their rules, the majority still stick to their transparency requirements. Smart winners often work with financial advisors and lawyers to find creative, legal solutions for maintaining their privacy, even in states where public disclosure is mandatory.

The bottom line? Total anonymity is rare in the lottery world, but with careful planning and the right legal strategy, winners can still protect some level of privacy, depending on where they live and claim their prize.

Are There Specific Demographics That Win Mega Jackpots More Frequently?

Let’s talk about who typically wins those massive lottery jackpots. You might be surprised, but there’s an interesting pattern when it comes to winners. The sweet spot seems to be folks in their middle years, particularly between 45 and 65 years old. Why? Well, these players often have more disposable income and tend to play more regularly.

Location plays a big role too. People living in busy city areas seem to have better luck, but there’s a simple explanation for that. Urban areas naturally have more players buying tickets, so it makes sense that more winners come from these populated regions.

Income levels also factor into the equation. Players with higher incomes tend to show up more frequently in the winner’s circle, mainly because they can afford to play more often and buy more tickets per game. But remember, winning the lottery is still purely chance – these patterns just reflect who’s playing more frequently, not who’s actually luckier.

It’s worth noting that these trends don’t mean you need to fit into these categories to win. Plenty of winners fall outside these demographics. The lottery doesn’t care about your age, where you live, or how much money you make – it’s all about having the right numbers at the right time.

What Security Measures Do Lottery Organizations Use to Prevent Jackpot Fraud?

Ever wondered how lottery organizations keep everything secure and trustworthy? Well, they’ve got quite an impressive security setup to make sure everything stays fair and square. Think of it as a virtual fortress protecting your chance at hitting the jackpot.

Let’s break down how they keep things safe. For starters, they use super-strong digital encryption, kind of like what banks use to protect your money online. Before any ticket becomes official, it goes through multiple verification steps, almost like going through airport security but for lottery numbers.

The tickets themselves are pretty clever too. They’re designed to be tamper-proof, so if anyone tries to mess with them, it’ll be pretty obvious. It’s similar to those security strips you see on paper money.

You know those big lottery drawings you see on TV? They’re not just for show. Every draw is captured on video surveillance, and they always have independent witnesses watching everything like hawks. Plus, independent auditors regularly check all their systems and procedures, just to make sure everything’s running exactly as it should.